The Homebuyer’s Timeline & Responsibilities

A Guide to Roles, Duties, and How a Real Estate Transaction Works.

Buying a home involves several phases, each with specific responsibilities for the buyer, the selling agent (also called the buyer’s agent), the listing agent, and the escrow/title company. Understanding these roles helps ensure a smooth and successful transaction.

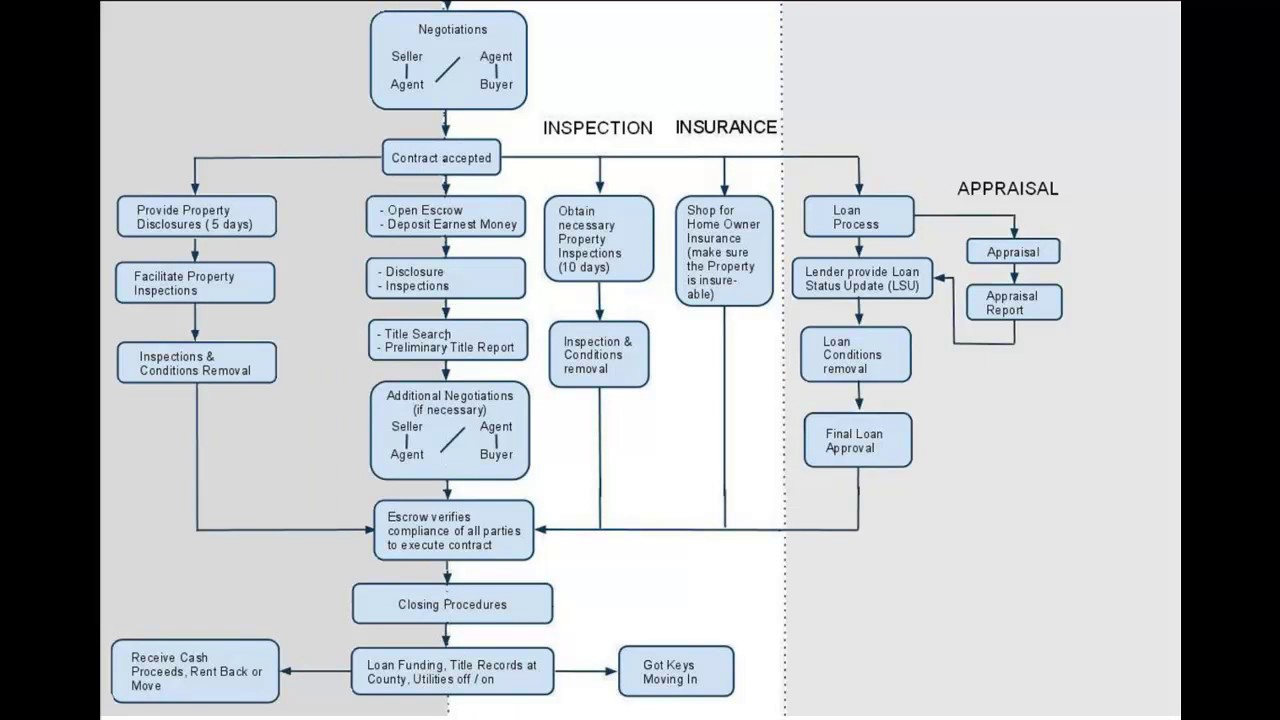

Homebuyer’s Timeline: Step-By-Step

1. Pre-Approval & Initial Preparation

-

Check credit score

-

Meet with a lender and obtain a pre-approval letter

-

Determine budget, location, and needs

Buyer responsibilities:

-

Provide accurate financial documents

-

Understand what you can afford

-

Research neighborhoods

2. Home Search

-

Touring homes

-

Attending open houses

-

Narrowing down options

Selling (buyer’s) agent responsibilities:

-

Provide property listings

-

Schedule showings

-

Educate the buyer on market conditions

-

Identify red flags during tours

3. Making an Offer

-

Offer price, terms, and contingencies

-

Negotiations begin

Buyer responsibilities:

-

Decide offer amount and terms

-

Be available for timely communication

Selling agent responsibilities:

-

Draft and submit the offer

-

Negotiate on the buyer’s behalf

-

Present comparable sales (comps) to guide pricing

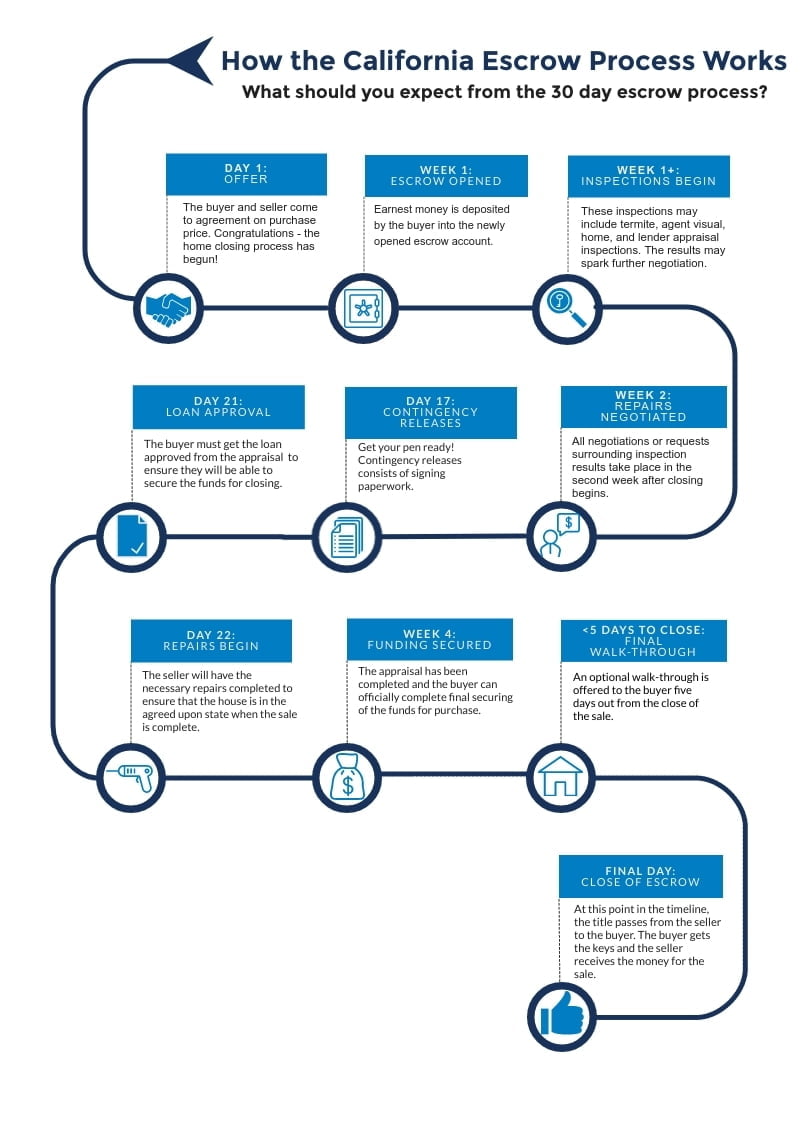

4. Offer Acceptance & Opening Escrow

Once the seller accepts, the parties open an escrow account.

Buyer responsibilities:

-

Submit earnest money deposit

-

Begin inspection period

5. Inspections & Due Diligence

Common inspections: general home inspection, pest/termite, roof, sewer, etc.

Buyer responsibilities:

-

Schedule inspections

-

Review inspection results

-

Request repairs or credits, if needed

Selling agent responsibilities:

-

Coordinate inspections

-

Guide the buyer on repair negotiations

6. Appraisal & Loan Finalization

The lender orders an appraisal to confirm the value.

Buyer responsibilities:

-

Provide any remaining financial documents

-

Work closely with the lender

Escrow responsibilities:

-

Coordinate with the lender for the required documents

-

Track contingency timelines

7. Closing Disclosure & Final Walk-Through

Buyers review final loan terms.

Buyer responsibilities:

-

Approve Closing Disclosure

-

Complete final walk-through to ensure property condition

8. Closing Day

Documents are signed, funds are transferred, and the deed is recorded.

Buyer responsibilities:

-

Sign the loan and title documents

-

Bring closing funds (cashier’s check or wire)

-

Collect keys after recording

Responsibilities of Each Party

A. Homebuyer (the Buyer)

-

Obtain financing & provide documentation

-

Review disclosures and reports

-

Decide on the offer strategy and negotiation limits

-

Attend inspections

-

Approve loan terms

-

Sign closing documents

-

Maintain communication throughout the process

B. Selling Agent (Buyer’s Agent) Responsibilities

The selling agent represents the buyer. This can be confusing because “selling agent” actually refers to the agent who brings the buyer, the one who ultimately “sells” the property by delivering a buyer. This is the same as the buyer’s agent.

Their responsibilities include:

-

Assessing the buyer’s needs and financial readiness

-

Searching for properties and arranging showings

-

Providing market insights and pricing guidance

-

Drafting offers and negotiating for the buyer

-

Managing contingency deadlines

-

Coordinating inspections, appraisal, and escrow activities

-

Protecting the buyer’s interests and ensuring contractual compliance

C. Listing Agent Responsibilities

Represents the seller, not the buyer.

Responsibilities include:

-

Pricing the home based on market data

-

Marketing the property (photos, staging, MLS listing)

-

Hosting open houses and showings

-

Communicating with potential buyers and their agents

-

Advising the seller during negotiations

-

Ensuring seller disclosures are completed

-

Coordinating with the seller throughout escrow

3. Escrow Company Responsibilities

The escrow company acts as a neutral third party that manages the transaction’s funds and documents.

Key duties:-

Hold the buyer’s earnest money deposit

-

Track contingency deadlines

-

Receive instructions from both sides

-

Ensure all conditions of the purchase agreement are met

-

Coordinate signatures for closing

-

Receive and distribute funds at closing

-

Release the deed for recording

Escrow does not represent either party—it is an impartial facilitator.

4. Title Company Responsibilities

The title company ensures the property has a clear, insurable title.

Key duties:

-

Perform a title search for liens, encumbrances, and ownership accuracy

-

Issue a preliminary title report

-

Offer title insurance to protect against future claims

-

Work with escrow to provide the necessary title documents

-

Record the deed with the county at closing

5. Listing Agent vs. Selling Agent (Buyer’s Agent): The Difference

Listing Agent

-

Represents: Seller

-

Role: Markets the property, negotiates on behalf of the seller, and seeks the highest price and best terms.

Selling Agent (Buyer’s Agent)

-

Represents: Buyer

-

Role: Guides the buyer, submits offers, negotiates on behalf of the buyer, and helps complete the purchase.

Why the name “selling agent”?

Because this agent brings the buyer—the person who actually buys the house—thus creating the sale.

Final Summary

| Role | Represents | Primary Duties |

|---|---|---|

| Homebuyer | Self | Financing, inspections, decisions, closing |

| Selling Agent / Buyer’s Agent | Buyer | Showings, negotiations, contracts, guidance |

| Listing Agent | Seller | Marketing, pricing, seller negotiations |

| Escrow Company | Neutral | Funds, documents, deadlines, closing |

| Title Company | Neutral | Title search, insurance, and recording |